Listen to article…

When you first look into buying gold, you’re immediately faced with a confusing mix of prices. You’ll see a “spot price” on a live ticker, hear reports about the “futures price” on the news, and see us at The Pure Gold Company refer to the “Spot price” on our charts.

It’s simpler than it looks, and understanding the difference is key to being a confident investor.

At The Pure Gold Company, we deal exclusively in physical gold and silver. The price that matters most to you, as a physical gold buyer, is the Spot Gold Price. Spot is the most widely referenced live trading price for wholesale gold.

The other prices you see, like futures, often relate to “paper” contracts or speculation. Let’s break down what each one means in plain English.

Gold Prices: At A Glance

| Price Type | What is it in Plain English? | What is it for? | Do We Use It? |

Recognised Benchmark Price | A widely referenced benchmark used in wholesale physical gold markets. | Large institutional pricing and settlement in the wholesale market. | No. Our charts use publicly sourced market data showing indicative spot prices. |

| Spot Price | The live market price for immediate (“on the spot”) gold transactions. | General market pricing, investor reference, and retail physical trades. | Yes. Our published prices update in line with global spot market movements. |

| Premium / Spread | The cost above spot (Premium) and the gap between a dealer’s buy/sell price (Spread). | Covers the cost of fabricating, insuring, and delivering a physical item. | Yes. This forms part of transparent pricing on physical gold products. |

| Futures (COMEX) Price | A price for gold to be delivered at a future date. | These contracts are financial instruments that do not require taking delivery of metal. | We deal in physical bullion rather than financial instruments such as futures contracts. |

1. Recognised Wholesale Benchmark Price

You can think of the recognised wholesale benchmark as a twice-daily snapshot used primarily in large institutional physical gold markets.

What is it?

A benchmark price set twice each business day through an electronic auction process involving major market participants.

Who sets it?

The auction is administered by an independent benchmark administrator and reflects participation from globally active bullion market institutions.

Why it matters (and doesn’t apply to most investors):

This benchmark is mainly used for pricing and settlement in wholesale transactions involving very large volumes of physical gold.

We do not use this price in our charts or client quotations — our published pricing reflects publicly sourced spot market data instead.

2. The Gold Spot Price (The “Live” Price)

The “spot price” is the price most commonly seen on financial sites and live tickers, changing throughout the trading week.

What is it?

It’s the live, rolling price for one ounce of gold to be bought or sold for immediate settlement. It trades nearly 24 hours a day, five days a week, following the global markets from Asia to North America.

Why do charts go flat on weekends?

Because the main global trading centres are closed, so price movement pauses until markets reopen.

It’s priced in US Dollars (USD):

Gold is priced globally in USD, meaning prices shown in GBP or EUR are simply the USD spot price converted via live exchange rates. This means UK pricing can move even if the USD gold price doesn’t.

Why it matters to you:

Your buy and sell prices in the UK are affected by two variables:

- the global spot gold market

- the GBP/USD exchange rate

Understanding both helps you see whether changes are driven by gold demand, currency shifts, or both.

From Ounces to Grams and Coins

Troy Ounce:

Gold pricing is based on a troy ounce (31.1035g), not a standard ounce used in cooking.

Price per gram:

Spot price per gram = spot price per troy ounce ÷ 31.1035.

Where coins fit in:

A one-ounce gold coin contains one troy ounce of pure gold, so its base value reflects the live spot price before premiums.

Spot Price vs Your Purchase Price (Premium & Spread)

New physical investors should understand that you cannot purchase a coin or bar at the raw spot price.

The spot price reflects the value of wholesale metal in large “Good Delivery” bars.

The price you pay includes a premium, which covers:

- fabrication and minting

- assaying and certification

- insured storage and delivery

- market demand for specific sizes and denominations

This leads to another related term: the spread.

- Premium = added to spot to form the retail price (Ask)

- Spread = difference between the dealer’s sell price (Ask) and buy-back price (Bid)

Premiums are the main component that creates the spread, enabling dealers to offer a two-way market for physical products.

3. The Futures Price & COMEX (The “Paper” Price)

You will often hear about the futures price or the COMEX price. This is not the price for physical gold you can hold today.

What is it?

A futures price is a contract based on what gold may be worth at a specific future date. Traders can speculate on price movements without taking delivery.

What is COMEX?

COMEX is a major exchange in New York where these futures contracts are traded.

Why it’s not relevant to physical buyers:

This market is used by speculators and institutions rather than people purchasing tangible gold.

We focus on physical ownership rather than leveraged paper contracts.

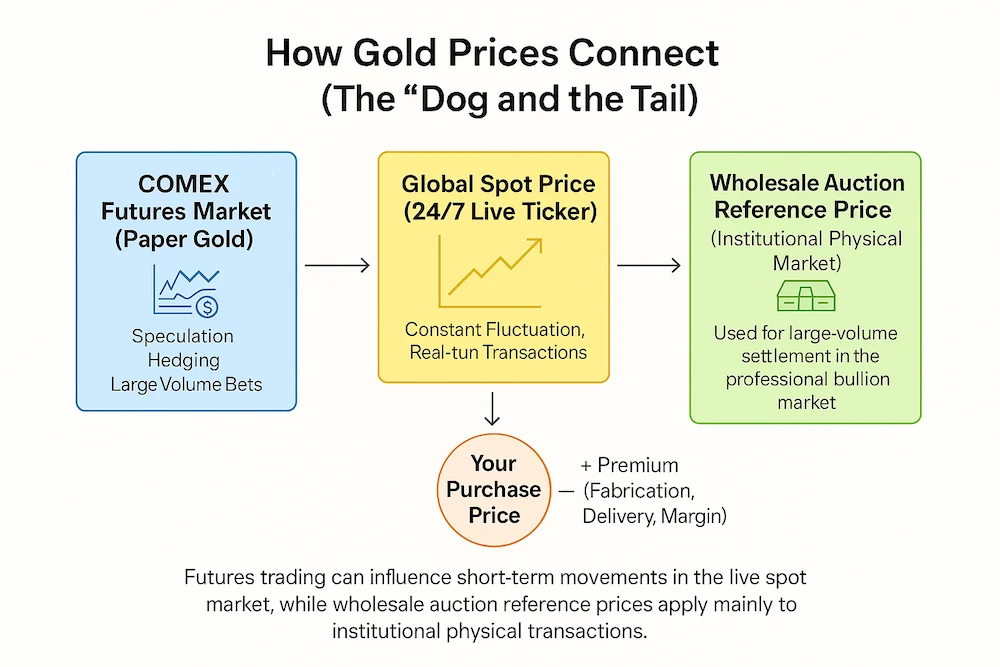

How These Prices Interact (The “Dog and the Tail”)

Here’s a cleaner and compliant way to express the relationship:

Futures markets can can contribute to short-term price movements

The futures market involves large volumes of trading based on expectations of future gold prices. Because of its scale and speed, activity in this market can contribute to short-term movements in the live spot price.

The Spot Price reflects the live market:

The spot price shown on financial tickers is the continuously updated global price for immediate settlement. It responds to both futures activity and real-world physical demand across global trading hours.

Wholesale reference prices relate to institutional physical settlement:

Separate from futures and spot pricing, wholesale auction reference prices are used mainly for pricing and settlement in large-volume professional bullion transactions rather than consumer purchases.

Why this matters for physical buyers:

Short-term price swings are often driven by speculative futures trading, while longer-term trends tend to reflect supply, demand, macroeconomics, and currency movements in the physical market. Understanding the distinction helps investors identify what is noise and what is meaningful when considering physical ownership.