Gold vs cash in the bank

From a young age we have been taught that keeping your money in the bank is safer than hiding it under your mattress. But cash will only retain its value if it is earning more in interest than the rate of inflation. .

During the rapid rise of inflation between 2021 and 2023, interest rates languished well below the double-digit inflation rate. To cool inflation, interest rates rose rapidly, so there was a period when the former was lower than the latter. But interest rates have been cut three times since mid-2024 and are expected to start to come down further in 2025, and savers will once again need to protect their cash from eroding value.

Gold vs other assets

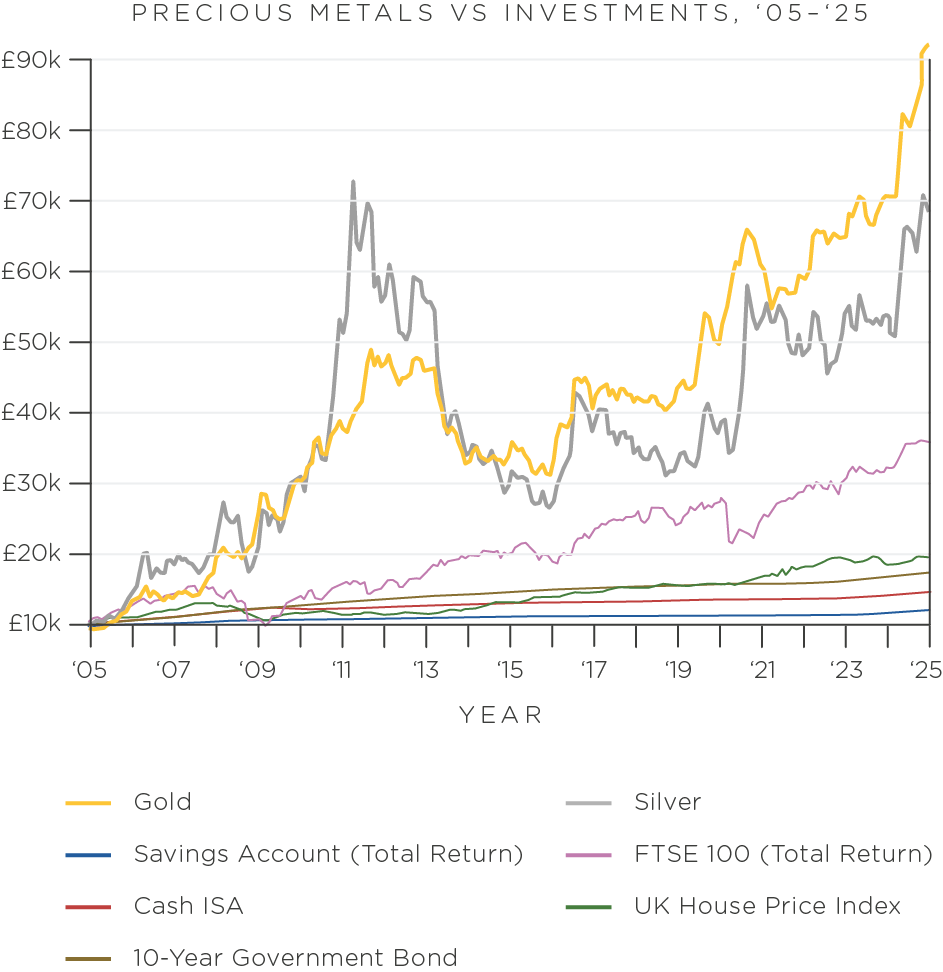

This graph tracks how much an investment made in January 2005 of £10,000 in gold or a bank savings account would be worth.

Cash left in a savings account for the same period:

- would be worth £12,114, the worst-performing investment choice.

As you can see, £10k invested in gold:

- would have been worth £92,468k in January 2025, significantly more than the rise in inflation.

Why Banks?

Banks began as institutions that existed to store money. They are one of the linchpins of the global economy, with the amount of interest paid to those who store money there a matter of concern for national governments and financial institutions. In conventional wisdom, banks are the place to store cash, as well as other financial instruments and asset classes including many kinds of bonds and equities.

Banks want more capital to invest for profit, and they provide a useful service to customers looking to borrow money in order to gain more capital. Storing wealth in the bank is convenient in the short term and reasonably secure from external theft, as advanced encryption protects a customer’s money, along with heavy security measures.

Comparing Banks & Gold

RISK

Gold

Owning physical gold comes as close to eliminating counterparty risk as possible. If it is to be stored, it can be stored in an allocated segregated vault, and if it is stored securely at home then only risk is theft.

Banks

The Global Financial Crisis showed that even large financial institutions can fail in times of extreme economic stress. It is clear now that even major banks come with an element of counterparty risk.

The aftermath of the crisis has been greater check on the solvency of banks, but there remains some risk in every contractual agreement, including holding cash in the bank.

INFLATION

Gold

There’s a finite supply of gold, it has been a safe-haven asset for centuries and the metal is in demand during political and economic uncertainty, which means that gold prices and the metal’s value is likely to increase over time. General fluctuations in price are expected but the long-term outlook for gold is steady growth.

As a commodity, it also tends to rise alongside other goods, meaning it can be a hedge against inflation in some circumstances.

Banks

The rising price of goods erodes the value of any cash you hold. Unless the interest you receive on bank deposits is greater than inflation, your money will be worth less when you come to spend it.

Interest rates have been very low for many years, and it has been hard to find rats that beat inflation, even when inflation was below the Bank of England’s target of 2%. However, inflation has surged to 40-year highs. And while the subsequent interest rate rises have prompted banks to lift their savings rates slightly, they are still well below the 10% inflation rate which means the value of any cash in the bank will be eroded quickly.

LIQUIDITY

Gold

Gold holds very similar liquidity benefits to cash. It is easily liquidated (with a buy back guarantee some gold can be liquidated within 24 hours), and it can be liquidated anywhere around the world. It’s not as immediate as cash, but it is almost as quick to turn gold into cash.

Banks

Often the main reason for keeping cash in the bank is for easy access when opportunities for investment arise. Investors can withdraw cash immediately, and this allows them flexibility to respond to changes in the market.

Looking Into Gold Investment?

Book a FREE consultation with our expert brokers at The Pure Gold Company.

Explore more gold comparisons

You might also like to read:

Learn more about getting into gold investment with our detailed guide on How to invest in Gold