Property and gold are both physical assets and often considered as “safe” investments when compared to, say, the stock market as you actually have physical possession of them. It is unlikely that their value will suddenly drop to nothing, and they can’t be digitally wiped out.

They are also both used as a hedge against both inflation and the fluctuations of the stock market as they tend to grow in value over the longer term** independently of what other markets are doing.

So, which one is best for safeguarding wealth in an uncertain world?

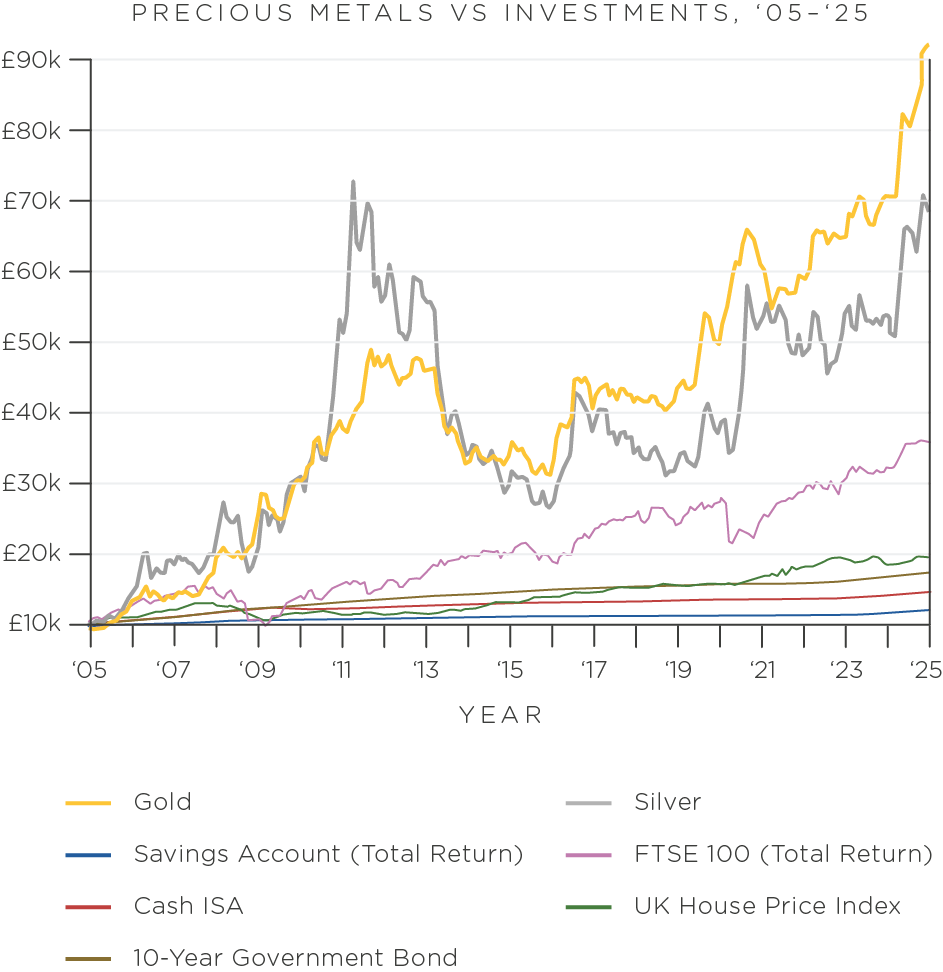

The graph below tracks how much an investment made in January 2005 of £10,000 in gold or property (represented by the UK House Price Index) would be worth 20 years later, tracked against inflation.

As you can see:

- A property investment of £10k: is worth £19,305, substantially less than gold.

- £10k invested in gold: would have been worth £92,468k in January 2025.

Property is often the largest investment people make in their lifetimes.

The property market has been on a steady upward trajectory since the crash of 2008, but as the crash showed, there is still the possibility of volatility even in bricks and mortar. Surging inflation has prompted the Bank of England to raise rates quickly, forcing mortgage rates up substantially, pricing some buyers out of the market.

After a fall in house prices in 2023, property prices returned to growth in 2024, although buyers remain very price-sensitive especially in light of uncertainty about mortgage rates in 2025. Interest rates remain much higher than we’ve been used to for more than a decade, squeezing potential buyers who are still contending with the effects of several years of inflation. Nationwide expects house prices to rise between 2% and 4% in 2025. Meanwhile, gold has proved time and time again that it both protects against financial uncertainty and offers a real chance to grow your investment portfolio.

- A completely Tax-Free investment*

- We offer a buy back guarantee

- Gold doesn’t follow the markets

- Insured delivery and storage options

- A private, physical asset away from the banks

- 2014 – 2024: Gold’s value increased 117.4%**

- The best performing asset of the past 20 years**

*Depending on your tax status and the type of gold being purchased. We provide full guidance.

** The value of gold like any investment is variable and can go down as well as up. Past performance does not necessarily indicate future performance.

Comparing Property & Gold

Physical asset

Gold

Gold’s rarity and immutability are the key reasons behind its abiding value. It’s a physical asset that can be held and owned directly, which reduces any counterparty risk.

It requires storage, though, either in a secure vault or a secure safe in the home or other premises.

Property

Property is also a physical asset, and as such shares its immutability with gold. The likelihood of damage beyond repair is very small, and as property is usually the most valuable asset a person owns, it is often passed onto the next generation.

That is, when it is paid off. Mortgages last decades and are subject to the vagaries of interest rates. If the funds from a property are needed, the costs associated with liquidating the property must be taken into account.

Liquidity

Gold

Gold is always in demand and very easily liquidated anywhere in the world. A buy back guarantee means your investment can be liquidated very quickly, often within a day. Gold coins come in smaller denominations than bars, so can be partially liquidated depending on need. Gold is often seen as almost as liquid as cash but without much of the risk of inflationary erosion in value.

Property

Property is a pretty illiquid asset. The process of selling up and releasing funds from a property can take months, or longer if there is a chink in the buying chain. There are also costs related to the sale, and capital gains taxes if selling a holiday home or buy to let property.

Risk

Gold

Unless somebody cracks the alchemy (unlikely), the risks associated with gold are small. The price may fluctuate in the short term, but the long-term trend has always been upwards1, and when interest rates go up or there is an inflation squeeze, the value of gold usually goes up as well. There is a much lower level of counterparty risk with physical gold compared to other assets as well.

Property

Buying a property to live in is usually a lifestyle choice rather than an investment one – you need a place to live, and it’s better to buy than rent. But there are still risks to buying property, including buying at the top of the market and going into negative equity if the market corrects, or taking on a large mortgage and then struggling to pay it if or when interest rates go up.

Taxes

Gold

Gold can be a very tax-efficient investment, depending on individual circumstances. Investment-grade gold bars and coins are VAT free and gold coins minted by the Royal Mint are capital gains tax-free as they are legal tender.

Property

The taxes associated with property vary depending on individual circumstances but second homes or investment property is subject to capital gains tax, and there is stamp duty payable on the purchase of property over a certain threshold.

Book a free consultation

We offer free 15 min, 30 min and 45 min consultations so you can ask as many questions as you like without feeling rushed.

Our expert brokers love to chat about all things Gold and Silver.

Explore more gold comparisons

You might also like to read: