What is ‘Paper Gold’?

Paper gold’ can be used as a proxy for the real stuff, but it’s essential to understand the pitfalls as well as the advantages when considering the type of gold that fits your portfolio.

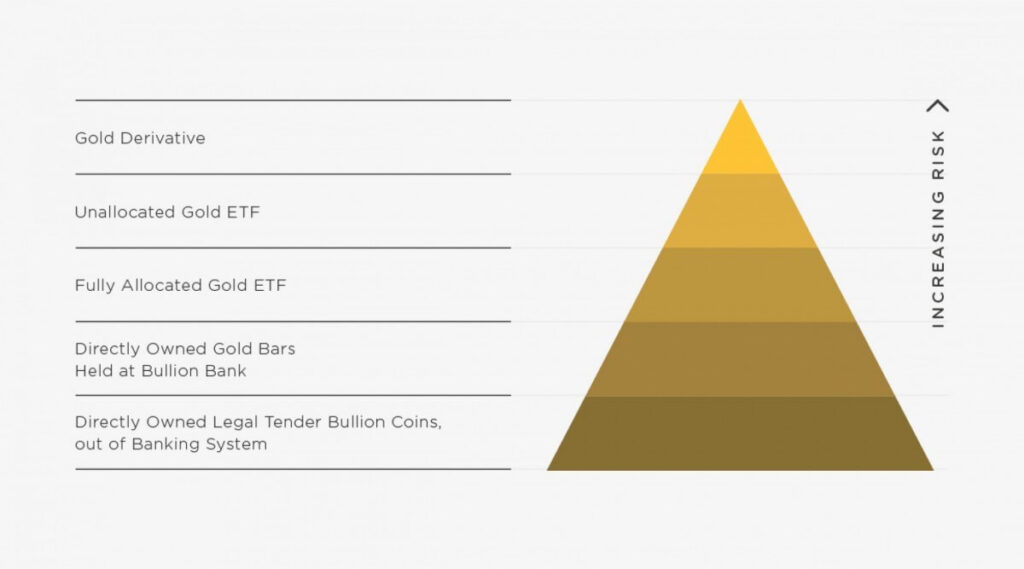

Paper gold is often better suited to short-term speculation and will not always insure your portfolio or harden your investments against financial turmoil. As the pyramid of risk shows, owning and investing in physical gold bullion is the least risky, most manageable and least taxed (depending on individual circumstances) way to secure your wealth with gold.

There are many ways to invest in gold, most of which don’t allow you to physically handle your own gold. The gold is yours on paper only, whether you invest in:

- An exchange-traded gold fund (ETF) or a traditional gold fund

- A mining company

- Gold futures trading or Contracts for Difference (CFD)

- Digital gold

- Spread betting

Ways to invest in gold

Exchange traded funds

- Gold-backed Exchange Traded Funds are funds in which you can trade shares like a stock. As the name implies the shares are backed by underlying physical gold stores and track the gold price. In most cases, it’s unlikely that a holder of a gold-backed ETF would be in a position to cash in their shares for physical gold, because the threshold for physical delivery is usually too high (over a million dollars for the most popular ETF).

- There is also some scepticism about whether the funds actually hold the full gold equivalent to back up the shares in their fund.

- ETFs are popular because they are very liquid and easy to trade but they are not risk-free.

- Even if you can’t liquidate your shares into gold, investors still have to rely on the fund to honour the investment. The fund is the first counterparty that comes with the risk of default, but it’s not the last. The fund will inevitably use a financial institution to source and store the gold, and they add a second level of counterparty risk to the investment. It’s possible there will be further layers of counterparty risk in certain ETFs.

- Although gold ETFs don’t attract spread charges, there are ongoing costs for holding the fund, and there may also be trading charges depending on which platform and ETF is used. ETFs also attract capital gains tax on the profit when sold. When considering a gold-linked investment, the risks and costs should be weighed alongside the liquidity benefits.

Mining stocks

Contracts for difference

- Investors who are intent on avoiding owning the physical gold asset, even if by proxy in a fund, may choose to trade a Contract for Difference. This is an agreement between a buyer and seller to exchange the difference in the value of an asset over time. The buyer never has to own the asset (gold in this case), and can profit whether the price moves up or down, so long as they correctly predicted the direction of travel.

- This complex instrument is really only suitable for experienced investors as it comes with greater risk (of losses or counterparty risk) than trading ETFs or physical gold, but may appeal to those with a higher risk profile who want to trade on gold price movements in either direction.

- Gold miners are another way to gain exposure to gold on the stock market. Listed mining shares are easily traded and reflect, in part, the fortunes of the gold price. But the actual spot gold price forms only a part of the value of a gold miner.

- Investing in gold mining stocks also means investing in the proficiency of management, the efficiency of operations, and the profitability of the company. In addition, investors take on counterparty risk, country risk depending on where their mines are located, safety risk, debt risk and other organisational risks that affect the share price irrespective of how the gold price performs.

- Mining shares are suitable for investors who want exposure to stocks that are linked to the price of gold but also reflect the corporate fortunes of the company. The highs are high but the lows can be very low, which ultimately undermines the objective of investing in gold, namely safety and security.

Digital gold

- Digital Gold is an electronic form of currency that is based on units of physical gold. The owner of the digital gold has claim on its physical counterpart but more often than not never chooses to ‘collect’ on the gold. Instead the digital gold can be held, sold, or used to make purchases.

- Ultimately, digital gold has to be issued and underwritten by a company or institution, and that carries substantial counterparty risk. Some digital gold is recorded in the same blockchain format as cryptocurrencies, and is held as tokens in a digital wallet and sold on exchanges. This association with cryptocurrencies may be detrimental to its reputation, but the argument is that unlike other cryptocurrencies, digital gold is backed by the physical product.

- Other institutions are selling digital gold within their own platforms as a way for investors to own gold without the restrictions of coin or bar weight. The gold is never delivered, but is allocated to the investor as a fractional part of a larger 400 gram bar, and can be bought or sold back to the provider digitally. This digital gold relies entirely on the counterparty to uphold their obligations, and it still incurs storage fees.

Spread betting

- Spread betting is another tool that enables an investor to bet on the movement of the price of gold (or any commodity, share or market) without actually ever owning it. Placing a ‘bet’ on the way the gold price will move means if it goes the right way, you can realise a profit, but by the same token if you bet wrong, you will incur losses. Investors also don’t have to cover the full cost of their ‘bet’, which means your gains can be greatly amplified, but so can your losses. Spread betting is incredibly risky and should only be undertaken by experienced investors.

Physical gold

- While paper gold will always have a place in the investment pantheon, physical gold has many inherent advantages. Paper gold is often portrayed as cheaper and easier to own but there are usually ongoing management and trading fees for owning paper gold in the same way as physical gold incurs storage costs (unless it is delivered).

- Investment grade physical gold is VAT free, and in currency coin format also incurs no capital gains tax. Taking delivery or utilising storage within a secure vault removes the counterparty risk associated with paper gold, removing it from the financial system altogether in a way that paper gold can never be.

- This is one of the most important advantages of physical gold, because in the event of financial upheaval, the yellow metal still belongs to the investor. Owning the physical metal is the best way to utilise gold’s safe-haven status and ensure investors benefit from its security and long-term store of value.

Discover all there is to know about buying gold for investment

Our free Investor Guide will reveal:

- How to invest in gold

- Timing & pricing considerations

- Our buy back guarantee

Discover all there is to know about buying gold for investment

Our free Investor Guide will reveal:

- How to invest in gold

- Timing & pricing considerations

- Our buy back guarantee