Gold Vs Shares

The Pure Gold Company CEO, Joshua Saul, talks to Rob Moore. Learn why big investors like Michael Burry are shifting towards gold, and how timing plays a crucial role in deciding the right investment strategy.

Explore the latest market trends, risk management tactics, and whether gold should be part of your portfolio.

Video Transcript

Should we be investing in gold? Or should we be investing in the stock market? Or should we have our money in savings? Now, interest rates have gone up. Well, it’s a good question. I’m a big believer in a diversified portfolio. But I also believe that there’s no point in being diversified for the sake of the word diversification.

It needs to make sense. I think when looking at investments, one has to look at what makes sense. Where is their value? Where is their opportunity? And so this week we’ve seen Zuckerberg, Jeff Bezos, and a whole plethora of A class players liquidate stock in their own company to the point where a lot of liquidity is moving out of the UK stock market.

So interestingly enough Michael Burry who back in 2008, he predicted the financial crash. He was the big short guy, wasn’t he? He was the big short. Everyone else believed that he’d lost his marbles. He placed, I believe a very, very large bet, we’re talking billions that the market would collapse.

And it turned out that he was correct. So it came out of equities. into liquidity, cash, gold, correct? Yeah. So then what way and then go back in? So what he did was he waited for that collapse. He took a load of insurance related securities. And so he made a lot of money. And then when the, when the market crashed, he bought back in.

The reason I’m mentioning it is because he seems to be doing exactly the same thing at the moment. And so he’s liquidated the vast majority of the equities that he’s invested in. There’s loads of articles about him online. And this time he’s actually using gold as his insurance product. And so he’s plowed it into, gold backed securities and some physical gold.

And he’s also bet against the market. He’s bet 1.26 billion that we’re going to see a repeat of what we saw back in 2008. And so to answer your question, what’s better gold equities or cash, I would say it’s a question of timing right now. If you’re trying to remove risk and seek protection, then gold will do that.

Gold and shares can both be attractive options for investment. However, while the rewards from shares can be big, they come with big risks. Gold is about long-term security and protection against uncertainty.

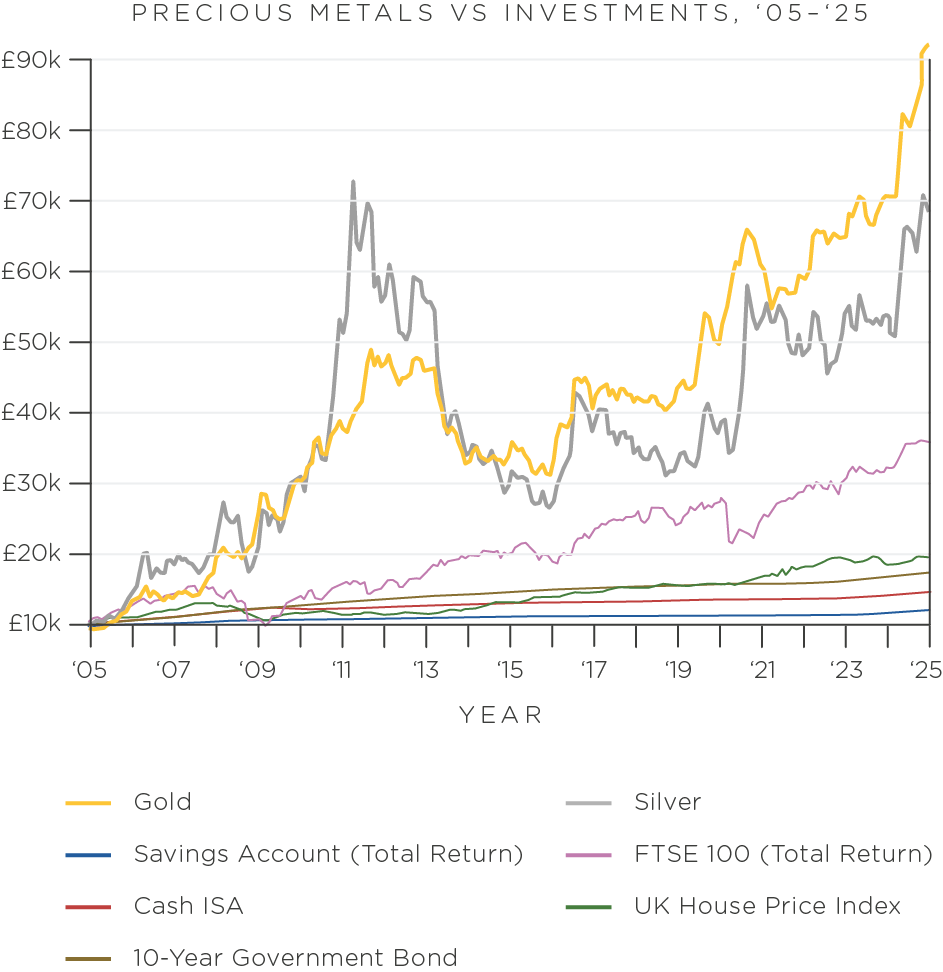

The graph below tracks how much an investment of £10,000 in gold and one on the FTSE 100 would be worth, tracked against inflation from January 2005.

As you can see:

- An average FTSE 100 investment of £10k: is only worth a little over £36,024

- £10k invested in gold: would have been worth £92,468k by January 2025.

Investment Risks

Stock markets in 2024 had a solid year, with rises and falls as geopolitical and economic events impacted markets but delivering generally consistent growth across the year. The outlook for 2025 is a little less clear, especially in light of the uncertainties caused by the tariffs implemented by the US and reciprocated by countries on the receiving end of US policy.

The fear is that supply chains and business growth will be impacted, pushing up inflation and potentially curtailing economic growth. This may also impact the easing of fiscal policy meaning interest rates could remain at elevated levels for longer than expected, squeezing consumers and businesses.

Meanwhile, markets remain wary of geo-political and economic shocks including the very fragile environment in the Middle East and the continued war in Ukraine.

The Safe Haven of Physical Gold

Gold on the other hand has proved time and time again that it can protect against financial uncertainty and offer a chance to grow your investment portfolio. In sterling terms, gold has already risen almost 27% in 2024, and long-term growth has vastly outperformed other asset classes. Meanwhile, the upsurge during the pandemic was a reminder to gold investors that it can be very effective protection in these volatile times.

Comparing Shares & Gold

Physical vs intangible asset

Gold

Gold’s rarity and immutability are the key reasons behind its abiding value. It’s a physical asset that can be held and owned directly which reduces any counterparty risk.

Shares

Shares are a form of intangible ownership. They are dependent on counterparties (the company, the stock market, the banks) upholding their obligations when buying or selling the shares. In the digital age, there is no longer even a physical share certificate.

Income Stream

Gold

Gold does not provide a regular income stream, instead it relies on an increase in value to realise a return on investment. For thousands of years gold has increased in price, retaining its buying power across the decades. This steady rise provides gold with its safe-haven credentials.

Shares

Depending on which shares you invest in, many provide dividends – money paid to investors from company profits which means that investing in shares can provide a regular income. This income is not guaranteed though, and dividends can change over time (be cut as well as increased) depending on how the company performs. The value of the underlying shares can also change, including falling to zero if the company fails.

Portfolio role

Gold

Gold within a balanced investment portfolio is used to hedge risk and in some cases inflation. It is a safe-haven asset which maintains or increases its value over time. Gold often increases when there is volatility in other markets and asset classes as investors look to protect their assets. It can also increase in value during calmer times as it rises along with other commodities and goods, acting as a relative hedge against inflation.

Shares

Stocks usually form a substantial part of an investment portfolio as there is a good opportunity for returns. Historically stock markets have provided good returns in times of market stability. But it is risky as this stability is not guaranteed. Investing in stocks is risky as individual stocks can be impacted by business decisions, while economic factors can have a negative effect on stock markets.

Book a free consultation

We offer free 15 min, 30 min and 45 min consultations so you can ask as many questions as you like without feeling rushed.

Our expert brokers love to chat about all things Gold and Silver.

Explore more gold comparisons

You might also like to read: